In News

The Union Finance Ministry has announced a substantial cut in corporate tax to boost the economy.

In-Detail

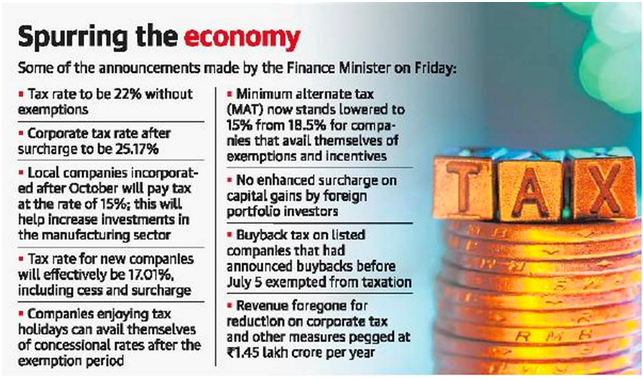

- The government has cut corporate tax for domestic firms to 22%. This, if the firm does not avail any other tax sops.

- By adding all the surcharges, the overall corporate tax now stands at 25.17%. This is a fall from the current 34.94%.

- The tax cut puts India at par with Asian peers.

Boost To New Manufacturing Units

- In a fillip to new manufacturing units that will be set up between October 1, 2019, to March 31, 2023, the effective tax rate will be 17.01%.

- Currently, such firms that Make In India have to pay income tax of 25%, including surcharges the effective tax rate is 29.1%.

- These firms are also exempt from MAT.

MAT Reduction

- The Finance Ministry also rolled back the enhanced surcharge on Foreign Portfolio Investors (FPIs) that was announced during the budget.

- Also, the Minimum Alternate Tax (MAT) has been reduced from 18.5% to 15% for all businesses. With this move, the government is set to lose Rs. 1,45,000 crore per year as forgone revenue.

Ordinance Route

- The government took ordinance route to bring in the changes and has amended the Income Tax Act of 1961 and the Finance Act of 2019.

Fiscal Arithmetic

- Some experts believe that the measure will lead to government overshooting its fiscal deficit target.

- They say that the fiscal deficit may balloon to 4.1% of the GDP.

- But, the Finance Ministry is confident that it will achieve its target of 3.3% fiscal deficit for the year.

- Experts also believe that mere reduction in levies will not lead to private sector investments as there is a lack of demand in the economy.

- Under subdued demand conditions, the private sector will invest only when the demand is revived.

- Some economists are of the view that the corporate tax cuts will make domestic firms competitive globally and foreign companies may invest in the country thereby boosting private investment.

Betting Big

- The Ministry is of the opinion that the measures will lead to more investments and more jobs and the economic activity will revive.

Cheers From India Inc.

- India Inc. has welcomed the move by the government.

- They believe that tax cuts will lead to corporate savings which will further be used to increase investments and generate jobs.

Conclusion

- The measures come at the right time and are expected to help the economy to get back to the growth path.

Courtesy: The Hindu

Courtesy: The Hindu

Leave a Reply

You must be logged in to post a comment.