In News

Bank Mergers – The Finance Ministry has recently announced mergers of several banks to create large banks. Let us find out the intention and impact of the move.

In-Detail

- As per the government’s plan, 10 Public Sector Banks (PSBs) will be merged to form 4 large banks.

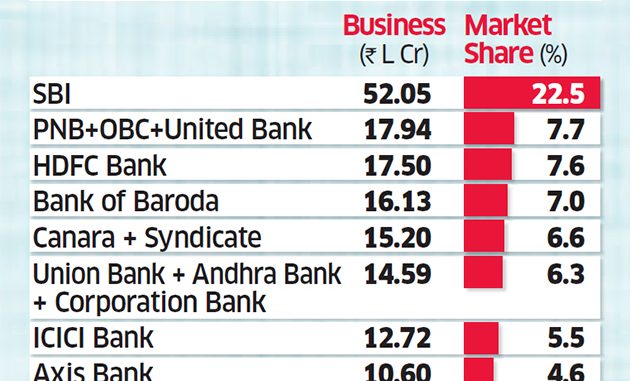

- The merger of Punjab National Bank, Oriental Bank of Commerce, and United Bank of India will form India’s second-largest bank after SBI.

- The other mergers are Canara Bank and Syndicate Bank; Union Bank of India, Andhra Bank, and Corporation Bank; Indian Bank and Allahabad Bank.

- With the mergers, there will be 12 PSBs operating rather than 27 in 2017.

How Merger Move Helps Banks?

- It was the M Narasimham Committee that had first recommended the merger of banks to have fewer bigger banks with better-management and better utilisation of capital, better operational management, wider reach and greater profitability.

- The logic is that with several banks operating, they will be vying for the same pie of deposits and loans in the narrow geographic areas which will incur costs on the banks. With larger banks, they will be responsive to emerging market trends and compete better with private banks.

- Also, the FM argues that big banks will compete with global-banks and improve operational efficiency once they reduce their cost on loans and increase loan disbursal.

- But, the argument of competing with the global banks seems a distant dream as no Indian bank is the top 50 global banks list.

Will It Aid the Government?

- Since 1992, with the government being the biggest stakeholder in PSBs, is provisioning capital for the banks in lieu of some loans going bad. This is being reflected in the budget every year.

- Government is of the opinion that with large banks the operational efficiency will improve and the number of bad loans will reduce thereby reducing the total amount to be set aside by the government.

- The amount thus saved could be invested in sectors like education, health and public infrastructure.

- Also, the government can now focus on fewer banks than before.

How the Banks for Merger Are Chosen?

- The government has chosen the banks based on no disruption in banking services, higher current and savings accounts, and greater reach.

- Also, the merged banks have a strong regional presence and will consolidate further. For example, Andhra Bank and Corporation Bank have strong presence in the South and the Union Bank of India has a strong presence in the West. The merger will lead to consolidation of the merged entity in these regions.

The Downsides of Merger

- Integration of operations among the merged entities is difficult to come by especially in the light of resistance from bank staff and unions.

- In the near term, there will be a disruption of services until the merger process gets completed.

- There will be issues like culture fit, staff redeployment, etc.

- One important issue will be the swelling of bad loans with these mergers.

- Another issue is the creation of systematically important banks with these mergers and providing bailout packages for these big to fail banks in times of trouble that could hit the government’s fiscal stability.

- For now, the mergers should not disrupt lending when banks are already sluggish at lending.

Role of RBI

- Any failure of a big bank will have an economy-wide impact. RBI being the regulator of banks should increase its supervisory and monitoring processes to see that these banks do not fail.

Issues with Mergers World Over

- Of the many bank mergers across the world, only 50% has succeeded with many facing problems of cultural fit and integration.

Conclusion

Consolidation of banks alone does not solve the problems being faced by the Indian PSBs. Governance is an issue. According to YV Reddy former Governor of RBI if the problem is structural and governance-related it doesn’t matter if the bank is small or large.

Best IAS Coaching in Delhi, Best IAS Institute in Delhi, Best Civil Services Coaching in Delhi, Best upsc coaching in Delhi

Leave a Reply

You must be logged in to post a comment.